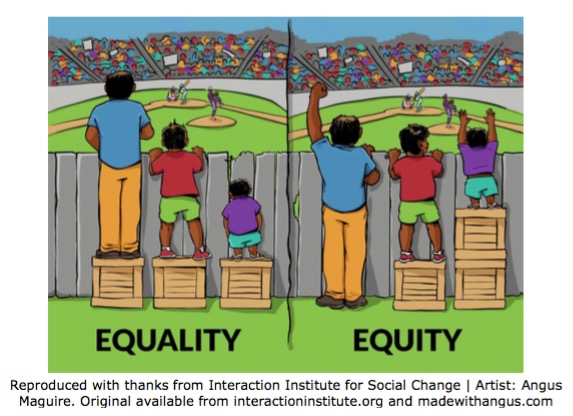

As the Greek negotiations wore on at the end of January, the price action in Portuguese government bonds became alarming, with yields on three-year bonds rising to over 19%. No matter that there is no legal challenge to this. More worrying than any of this, the abrogation of the principle of equal treatment for all holders of the same class of security will come at a cost. The suspicion is that many other hedge fund owners of Greek bonds would not be too upset by a disorderly default that triggers payouts on the CDS that some no doubt own. Some hedge funds will have bought at such low prices that they could even make money on a substantial write-off to par. There is at least one hedge fund manager on the IIF steering committee. The IIF has claimed to speak for the bulk of private-sector creditors but it is not entirely clear what volume of outstanding Greek debt it accounts for. The IMF showed it no longer stood shoulder to shoulder with the ECB when it declared achieving a sustainable debt position for Greece the overwhelming priority and called on various parties to find their way to provide the debt forgiveness to achieve that.Īs Euromoney went to press the outcome was unclear. However divisions between official-sector parties to the Greek debt restructuring negotiations are revealing. But there’s only so far the banks can push the ECB, considering it is all that stands between most of them and oblivion. The banks may have complained at being asked to take an unequal share of the losses and the IIF used the threat of a failed negotiation triggering credit default swap contracts and bringing wider disruption to the sovereign bond markets as a negotiating tactic. After all, they bought bonds and provided loans only to bail out original creditors in the first place. The ECB and indeed bilateral sovereign creditors are allowed to hold out for preferential treatment and their ability to achieve it comes down to power not principle. Bonds issued under Greek law – most of its outstandings – carry no provision for pari passu treatment of different creditors. There was no legal obstacle to the European Central Bank resisting calls to take its share of the burden by writing off a portion of its substantial claims on Greece, even just giving up the discount to par value at which it purchased Greek bonds from international banks. Certainly the principle of equal treatment of creditors was jettisoned very early on.

In the wrangling over the extent of private-sector debt forgiveness needed to return Greece’s finances to a sustainable path, one must wonder how much good faith has been shown and how much transparency.

0 kommentar(er)

0 kommentar(er)